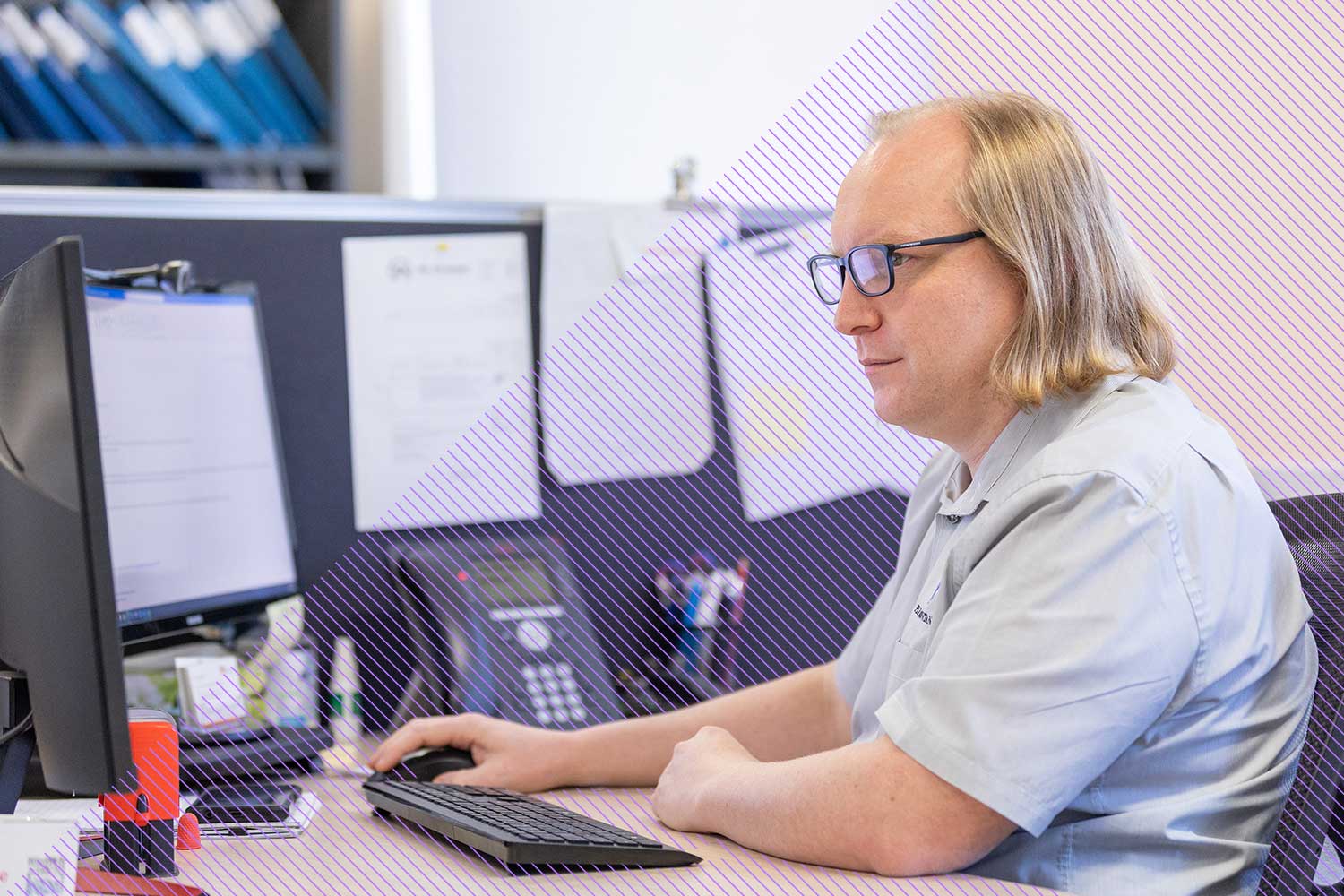

Small to Medium Sized Business – Compliance

End of Year Financial Accounts & Income Tax Compliance

We can prepare end of year financial accounts & income tax returns for your small to medium company, trust, partnership or sole trading business, using your cloud file or other record management system. We can also prepare interim financial statements or management reports, which are often required for loan applications or general meetings.

Once we have assessed your business’s individual circumstances we will discuss other compliance matters where necessary, including GST registration, PAYG Withholding, Long Service Leave, Fringe Benefits, Taxable Payments Reporting etc.

At PLH Accountants, we strive for a 3-4 week turnaround, from the time all information is supplied to the completion of your financial statements and tax returns as we understand extensive turnaround times can be frustrating.

Our Services

Personal Tax

We pride ourselves in our extensive income tax knowledge and the ability to take complex matters and translate them into plain English.

Small to Medium Sized Business - Compliance

We can prepare end of year financial accounts & income tax returns for your small to medium business.

Tax Planning & Advisory

We can create management reports for your business, compare with Australian standards and previous periods to get a picture of how the business is performing.

Bookkeeping

We offer a full one stop shop for all your bookeeping needs.

Self-Managed Superannuation Funds

Our team can answer any of your self-managed superfund queries.

Wealth Creation Strategies

We work as a team to bring you structural and tax advice on potential investments.

ASIC Services

We provide invaluable services to our clients by managing their ASIC compliance effectively.

Property & Equipment Finance

We can assist you in the process of finding finance for purchasing property and business assets.

Free Business Structure & Health Meeting!

Get your free business structure & business health meeting now!

Our Accreditations